ATTENTION: White Hats

This is the sign you have been waiting for... 2026 is the year.

White Hats -

Shutdown the Deep State:

1. Drain, hack, and cut off their money supply.

2. Disrupt & hack their communications.

3. Expose & humiliate their leaders.

\

\

A. Lloyd’s Banking Group

- Founded in 2009, but has a history that dates to 1765 or earlier.

- Largest corporation in the world by market cap - 10X larger than entire NYSE.

- Massive fraud.

- Traded on the London Stock Exchange.

LLD1

LLD2

LLD3

LLD4

etc.

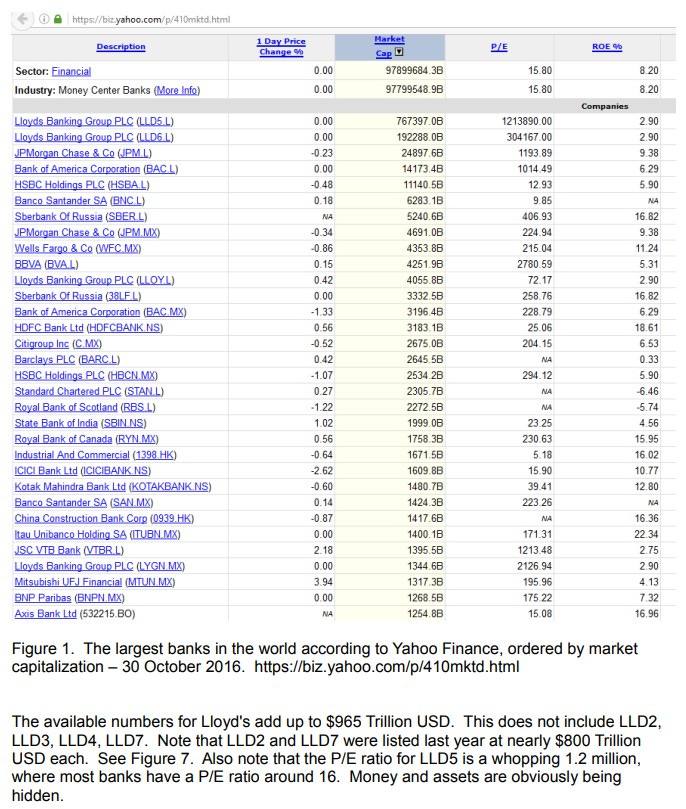

Each of these stocks has a market cap exceeding $100 Trillion. Total market cap exceeds $2 Quadrillion. The number of outstanding shares is being hidden. Audit the share count. Who are the majority shareholders? Who controls proxy votes? Ratio comparisons prove the fraud - number of customers vs real revenue, number of branches vs real revenue, EPS, fraudulent filings for mortgage losses, etc.

- SEC Rule 10b-5 violations for U.S. holdings

- RICO Act

- Foreign Corrupt Practice Act (FCPA)

- Blackrock, Vanguard, and State Street brokers know a little...

\

Watch for the transfers - this is when the assets are most vulnerable.

\

Executives with some of the secrets:

Robin Budenberg (chairman)

Charlie Nunn (chief executive)

\

Former chairmen:

Sir Victor Blank (2009)

Sir Winfried Bischoff (2009–2014)

Lord Blackwell (2014–2020)

\

Former chief executives:

Eric Daniels (2009–2011)

Sir António Horta-Osório (2011–2021)

Wives and children may know some of the secrets. Look for vulnerabilities.

\

CRIMES

*Source: wikipedia.org

Money laundering

A 2010 report by The Wall Street Journal described how Credit Suisse, Barclays, Lloyds Banking Group, and other banks were involved in helping the Alavi Foundation, Bank Melli, the Government of Iran, and others circumvent US laws banning financial transactions with certain states. They did this by stripping information out of wire transfers, thereby concealing the source of funds. Lloyds Banking Group settled with the US government for US$350 million.

Tax avoidance

In 2009, a case was brought against Lloyds by HM Revenue and Customs on grounds of tax avoidance. Lloyds was accused of disguising loans to American companies as investments in order to reduce the tax liability on them.

Complaints via the Financial Ombudsman Service

Lloyds TSB received 9,952 complaints via the Financial Ombudsman Service in the last half of 2009. This, when added to the other brands of the Lloyds Banking Group, was twice the number of complaints received by Barclays—the next-most-complained-about UK bank.

Islamic Account

In 2014, Lloyds launched the ‘Islamic Account’, a current account aimed at Muslims which it stated was compliant with Sharia law – namely, the prohibition of credit or debit interest. Critics of the new policy stated that the account amounted to religious discrimination.

HBOS Reading fraud

Lloyds Banking Group has been criticised for failing to compensate, or even apologise to, victims of fraud perpetrated by employees of HBOS. LBG was accused of treating the whistle-blowers involved in the HBOS Reading fraud poorly. Sally Masterton was an accountant working for Lloyds who greatly assisted Thames Valley Police in their investigation of the fraud, codenamed Operation Hornet. She wrote a report on the fraud at the request of the bank, called Project Lord Turnbull.

Lloyds Business Support Unit

A review conducted by Thames Valley Police indicated that fraud may have been committed at the Lloyds Business Support Unit based in Bristol. Lloyds Banking Group has denied this. More than two hundred alleged victims have asked the police to investigate their claims.

\

\

B. Toyota Motor Corp

Also traded on the London Stock Exchange. Market cap exceeds $2 Quadrillion.

More to follow...

\

\

White Hats:

4. Do not take unnecessary risks.

5. Trust no one.

6. Be clever. Think outside the box.

Thank you for your service.

\

Also see our prior newsletter:

https://targetedjustice.substack.com/p/rockefellers-and-rothschilds-where?

\

The corporate money on the London Stock Exchange was stolen thru the fraud of Central Banks, including the Federal Reserve.

An audit of the Federal Reserve will prove its source.

/